A few months ago, I researched index investing in India on the spur of the moment.

However, since the information was too lacking, I would like to conduct additional research.

About the iFreeNEXT Indian Equity Index

First, let’s take a look at the “iFreeNEXT Indian stock index” that I bought for the time being.

First, let’s refer to the investment trust manual (delivery prospectus) that comes out when purchasing at SBI SECURITIES.

It seems that this investment trust will be managed to track the index “Nifty50”.

Invest in Indian equities and follow the movement of the Nifty50 index (dividend included, yen basis)

We aim for linked investment results.

The Nifty50 is an index composed of 50 stocks listed on the National Stock Exchange of India and is replaced every six months.

In addition, basically nothing comes out even if you look at the constituent stocks.

This is out of the question, so let’s take a look at the index called Nifty50 this time.

In addition, Daiwa Securities has published a fund letter with the content “Introduction of the top stocks included in the iFreeNEXT Indian stock index Nifty50 index”. Based on this, let’s unravel it by adding our own interpretation.

https://www.daiwa-am.co.jp/fundletter/20230608_03.pdfIn addition, this Nifty50 seems to be updated once every six months.

It will be delivered with the information as of July 23, 2023 at the time of writing.

Survey Nifty50 constituent stocks

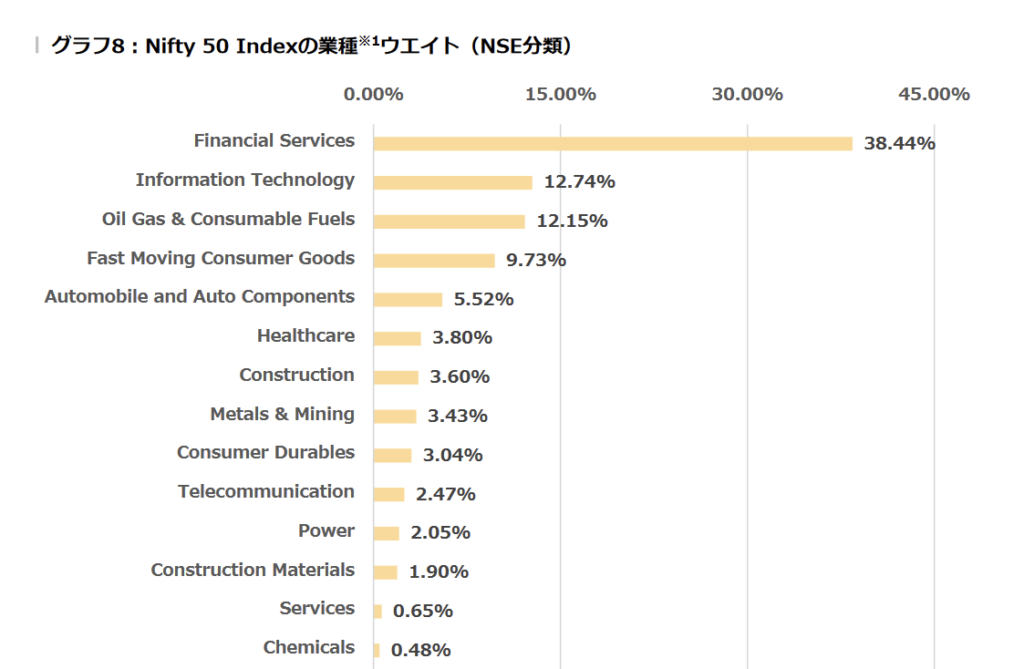

Diversification by industry

I think that what readers want to focus on when making investment decisions is the diversification of industries, so I dared to interrupt here.

This is a quote from Daiwa Securities’ materials at the end of May 2023, but apparently about 40% are in the financial industry.

This is followed by the information and communications industry at 12.74%, petroleum-related industries at 12.15%, and daily consumer goods at 9.73%.

In addition, it will continue with automobiles, health, construction, and metal resources.

How you see this is up to the reader’s interpretation.

Reliance Industries(10.28%)

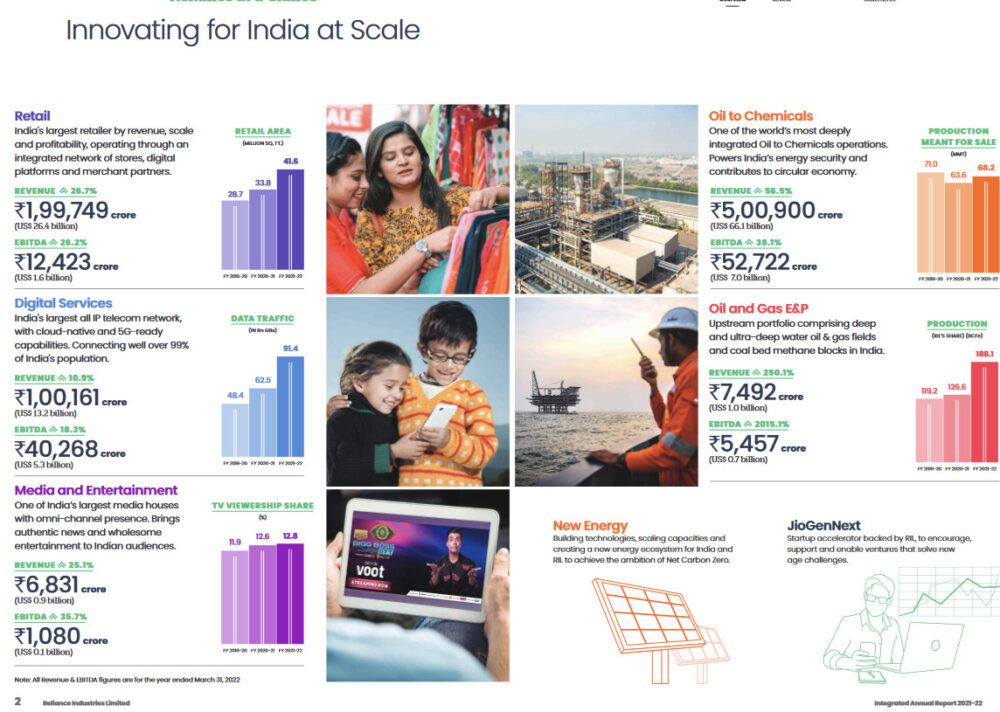

This company, which suddenly took 10%, is simply a company that mines and processes oil.

The business introduction tab on the official website also has this.

It actually owns an oil field, and it seems to boast a production volume that accounts for 30% of India’s output.

In addition to drilling for oil, it also refines it in-house.

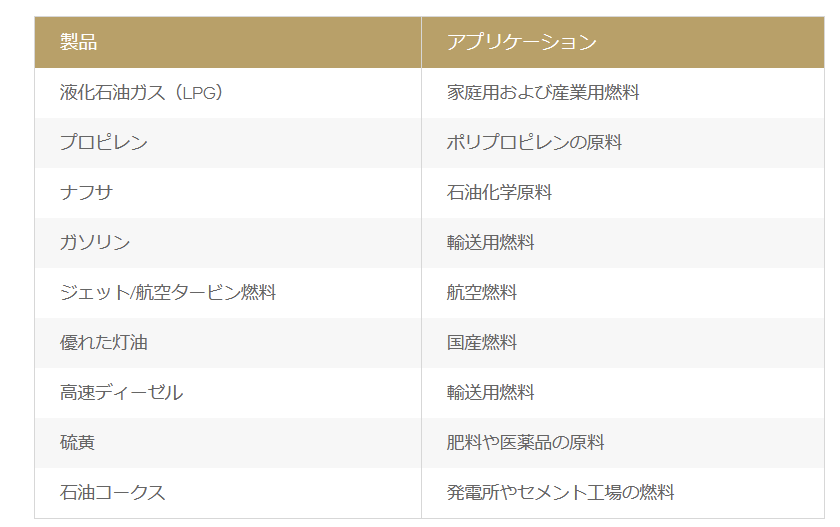

It has the world’s largest refining base called “Jamnagar Refinery”, and it can be seen that it exports after processing it into the following products.

In addition to petroleum, it seems that they are also producing sustainable energy for the next generation.

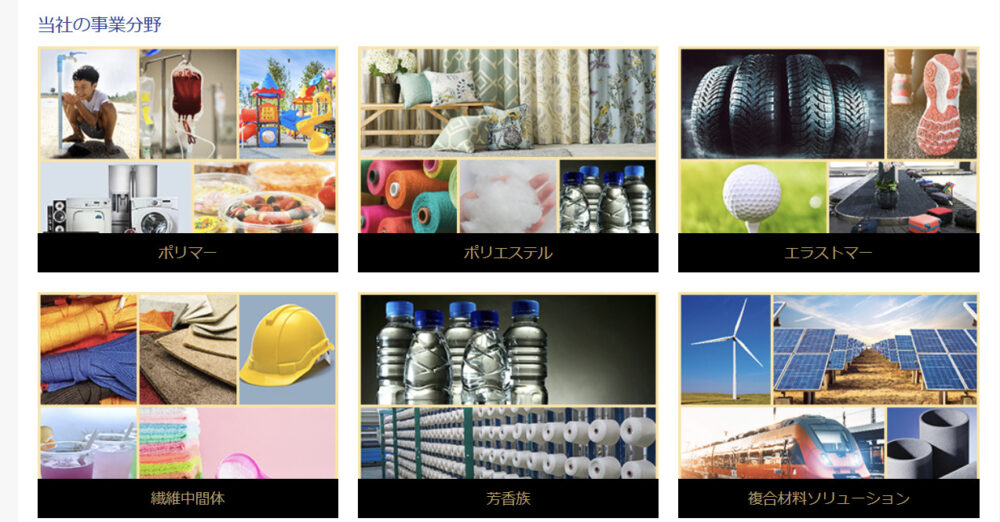

In addition, the company also deals with cloth and textile-related products, from general clothing to materials for automobiles, which require flame retardancy.

We also deal with a myriad of compounds that are also petroleum-based.

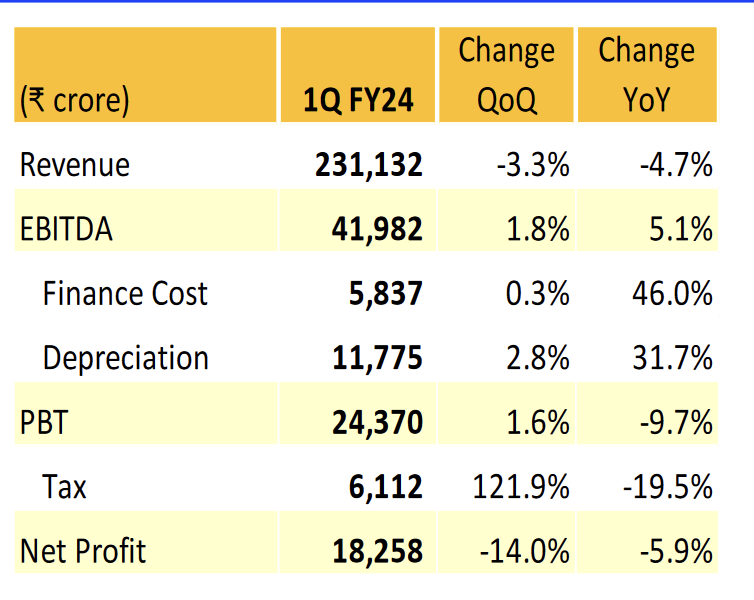

I looked at the financial documents for the time being, but the units were unclear, but there seemed to be no problem.

As far as I can see from this document, it seems that it will continue to grow steadily, but I can’t look at the 250-page document one by one.

HDFC Bank(8.73%)

A large bank in India.

Mainly handles loans, credit cards, payment services, etc.

It is a large company with 68 million customers and about 180,000 employees.

It is the fourth largest bank in the world by market capitalization.

If you want to know more about financial results, you can search for financial statements from the “Investor Information” section somewhere on the official website.

There are a lot of English sentences like this, so if you can read it, please read it.

Google translation cannot be used for pdf files, and it is very difficult…

…I know things are going well for now.

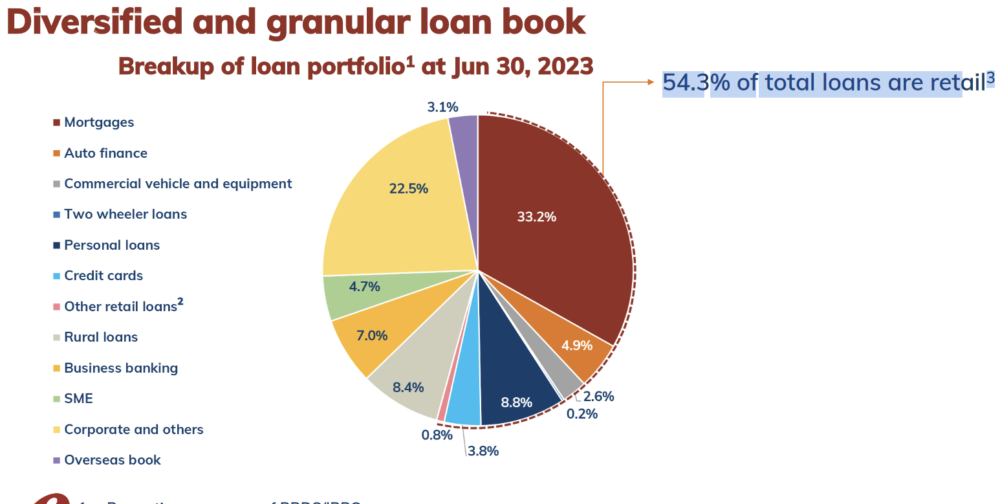

ICICI bank(8.15%)

It’s a bank again. The second and third banks and banks followed, reaching 16% of the total.

In addition, compared to HDFC Bank, which was in second place, it seems to have strengths in IT services.

I’ve been looking all over the official website, but I can’t seem to find any details…

In this document, it seems that the content is something like “54.3% of loans are for individuals”.

Housing Development Finance(5.88%)

Also financial. The financial sector alone has already exceeded 20%.

This is India’s largest housing finance company.

By the way, isn’t HDFC written again? ? ? ?

Apparently this is the parent company and HDFC Bank is a subsidiary of Coco.

It seems that it started as a company specializing in housing loans, and has adopted the Internet from an early stage to develop a variety of loans.

Looking at wikipedia here, is the performance good?

In this day and age, everyone has a bank account, so it might not be a bad idea to think that you can receive a solid demographic bonus.

It’s also the company that handles the biggest purchase of most people’s lives: mortgages. Real estate is huge. Of course, we also offer it to companies.

infosys(5.79%)

This time it is an information and communication company. A major IT company in India that provides consulting and software services.

Since the 1990s, he has successfully followed the trend of national policies and the spread of the Internet, and has grown by successfully receiving work from various developed countries, including Europe and the United States.

He probably took advantage of the strengths of Indian human resources, who have high English and technical skills, and low unit prices, and the time difference, which says, “The work I asked you to do before going to bed will be finished by the time you wake up.”

Eventually, it became the first Indian company to be listed on the NASDAQ.

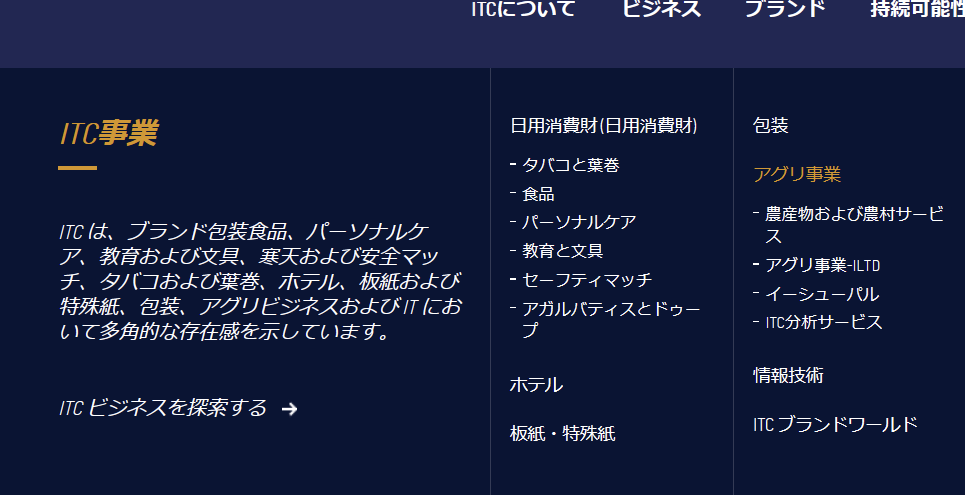

ITC(4.83%)

I’m tired, so let’s finish this. It’s a fast-moving consumer goods company.

They sell cigarettes, food, etc.

It seems to be written on the official website that hand-rolled cigarettes called “armenteros” are representative products.I can’t find any detailed information after searching. This image is not from the official website.

They also seem to have food from the following brands. Let’s do some research.

Something like jam biscuits

what is this…

It looks like wheat flour.

Crisps.

It’s a type of sweets that you often see in Japan, probably in supermarkets and convenience stores.

Finally

I’m going to stop here because it’s too much trouble, but it seemed that “a system that fully benefits from the demographic bonus”, such as oil, finance, and food, was in place.

Even if you don’t have detailed knowledge or careful consideration, if it’s an Infex fund, it looks like it’s good to accumulate brain death.

References